Travelling allowance for the tax year ending 2025

When a travel allowance has been received, the employee must determine the

allowable deduction for business travel. There are two ways in which this could

be done:

- Using actual business expenditure (The value of the vehicle is limited to R800 000 for purposes of calculating wear and tear, which must be spread over seven years, while finance costs are also limited to a debt of R800 000.

- For a leased vehicle the instalments in a year of assessment may not exceed the fixed cost component in the table), or

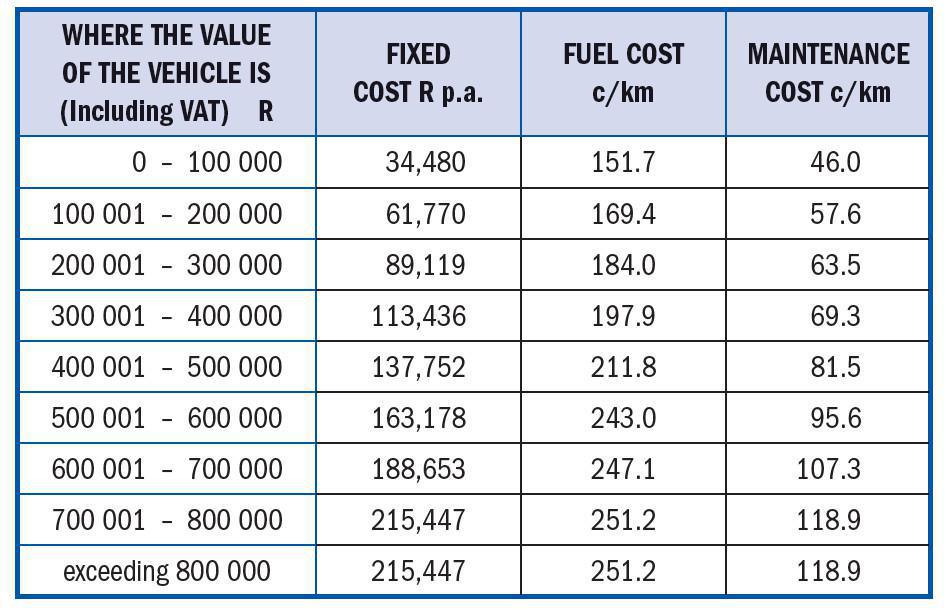

- Using a deemed cost per kilometre as per the following table:

Note: The fixed cost must be reduced on a pro-rata basis if the vehicle is used for business purposes for less than a full year.

The actual distance travelled during a tax year and the distance travelled for business purposes substantiated by a log book are used to determine the costs which may be claimed against a travel allowance.

Employees’ tax is based on 80% of the travel allowance. However, if the employer is satisfied that at least 80% of the use of a motor vehicle will be for business purposes, employees’ tax may be based on 20% of the travel allowance.

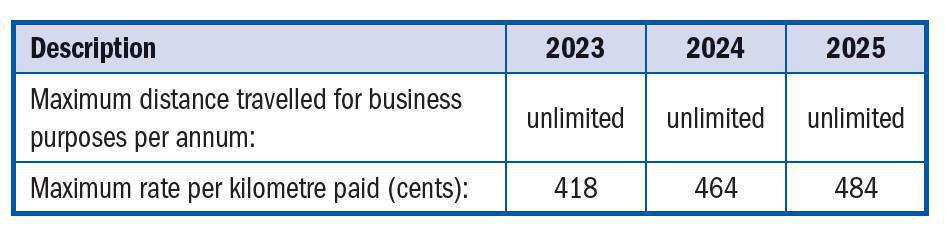

When the following criteria are met, no employees’ tax is payable on a reimbursive travel allowance paid by an employer to an employee:

This alternative is not available if other compensation in the form of a travel allowance or reimbursement (other than for parking or toll fees) is received from the employer in respect of the vehicle. In such an instance the reimbursive travel allowance will be taxable and expenditure for business travel could be claimed in the same manner as with a normal travel allowance.

Right of use of motor vehicle

When an employee receives the right to use a motor vehicle the following

provisions apply:

- Where the vehicle is owned by the employer, the taxable value is 3,5% of the determined value (Vehicles purchased before 1 March 2015: The cash cost including VAT; Vehicles purchased on/after 1 March 2015: Retail market value) per month of each vehicle. Where the vehicle is the subject of a maintenance plan at the time that the employer acquired the vehicle the taxable value is 3,25% of the determined value.

- Where the vehicle is rented by the employer, the monthly taxable value is equal to the actual costs incurred by the employer under the lease (rental and insurance for example) as well as the cost of fuel for the vehicle.

- 80% of the fringe benefit must be included in the employee’s remuneration for the purposes of calculating PAYE. The percentage is reduced to 20% if the employer is satisfied that at least 80% of the use of the motor vehicle for the tax year will be for business purposes.

- On assessment the fringe benefit for the tax year is reduced by the ratio of the distance travelled for business purposes substantiated by a log book divided by the actual distance travelled during the tax year.

- On assessment further relief is available for the cost of licence, insurance, maintenance and fuel for private travel if the full cost thereof has been borne by the employee and if the distance travelled for private purposes is substantiated by a log book.

Subsistence allowances and advances

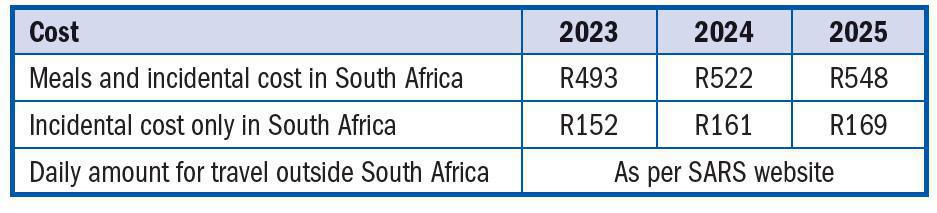

Where an advance or allowance is received by an employee for meals and other incidental costs, he / she can deduct either:

- The amount actually spent (limited to the advance or allowance), or

- For a day trip where employee is not spending at least one night away from his/her normal place of residence, an amount not exceeding R169.

- The daily amounts set out in the table below where the employee is obliged to spend at least one night away from his/her usual place of residence on business. When the deemed amounts are used, the employee does not haveto produce proof of the amounts spent and the allowance is not subject to employees’ tax.

Residential accommodation

The fringe benefit to be included in gross income is calculated in the following different ways, depending on the circumstances:

- Using a formula less the amount paid by the employee

- Using the lower of a formula or the cost borne by the employer less the amount paid by the employee

- When holiday accommodation has been provided, the fringe benefit will be the rental cost of the employer or prevailing market rate per day depending on the circumstances

Low-cost housing

No fringe benefit will arise if an employee acquires a house from their employers at a discount (i.e. at a price below market value) if the following requirements are met:

- The employee does not earn more than R250 000 in salary during the year of assessment in which the acquisition took place

- The market value of the property that is acquired may not exceed R450 000, and

- The employee may not be a connected person in relation to the employer

Interest-free or low interest loans to finance the above stated low cost housing will not be regarded as a fringe benefit if the loan also does not exceed R450 000.

Interest-free or low-interest loans

The difference between interest charged at the official rate and the actual amount of interest charged on employee loans, is to be included in gross income.

Short-term loans granted at irregular intervals to employees are, however, exempted to the extent that it does not exceed R3 000.

Bursaries

Bursaries are exempt from tax where:

- the bursary is granted to an employee who agrees to reimburse the employer for the bursary if the employee fails to complete his studies for reasons other than death, ill-health or injury, or

- the bursary is granted to a relative of an employee that earns less than R600 000 per annum and to the extent that the bursary does not exceed R20 000 (R30 000 for disabled relative) grade R to matric and R60 000 (R90 000 for disabled relative) for further education. The bursary cannot be as a result of any salary deduction taken by the employee.

Medical fund contributions

Medical fund contributions paid on behalf of an employee is a fringe benefit. As a result the employee is deemed to have made the payment to the scheme and may get a tax credit.